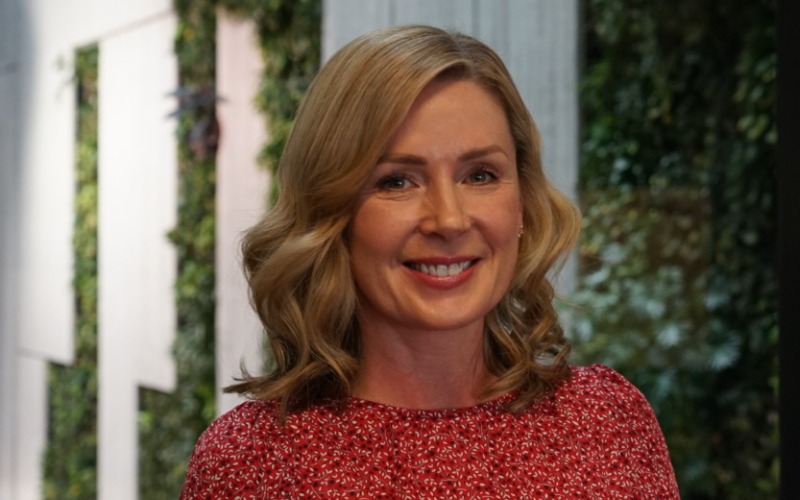

PEXA is an online property settlement platform used by 150 financial institutions as well as more than 9,000 legal and conveyancing firms across Australia. Lisa Dowie, Chief Customer Officer for PEXA, explains how PEXA’s commitment to providing exceptional experiences for its members and employees has helped the organisation cope with the COVID-19 pandemic.

A world first, PEXA was founded in 2010. Until this point, property settlement in Australia involved an inefficient paper settlement process that had changed little in the previous 150 years. Dowie comments, “Prior to the establishment of PEXA – lawyers, conveyancers and representatives from the banks for both the buyer and the seller of a property would need to meet in a physical settlement room. They would swap loads of paperwork and bank cheques and take them away to be processed.”

Now with PEXA, properties can be settled quickly and efficiently online. “The platform completes the lodgement with the land registry, registering the new owner of a title as well as transferring the necessary funds. PEXA’s members, the lawyers, the conveyancers, and representatives of the banks involved in settling properties no longer have to attend physical meetings or handle massive amounts of paperwork.”

“Today, 75% of all property settlements in the country now happen on PEXA. We have processed more than 5.6 million property settlement transactions which equates to about $950 billion in property value.”

The member experience journey

Lisa Dowie joined PEXA as an IT project manager in the early stages of the platform being developed. She reflects, “The early days were really about building the platform. When that was done, we needed to start engaging with lawyers and conveyancers and getting them to use the platform. Viewing them as members rather than customers, we realised we needed to do more than build a technology platform. To deliver maximum benefit, we needed to put our members and the experience they have with us at the heart of everything we do.”

Four years ago, Lisa moved out of her role in IT project management to become PEXA’s Chief Customer Officer. Lisa kickstarted PEXAs member experience journey by implementing three key initiatives, that included:

- Obtaining executive and stakeholder ‘buy in’

- Investing in a member feedback program

- Building an online community for members and PEXA employees

Obtaining executive ‘buy in’

The first stage in PEXA’s member experience journey was to garner support from the executive team. Without that it would be almost impossible to move forward. Dowie presented a strategy of what she wanted to do and what she expected that would achieve. She says, “We shared a lot of stories about what other businesses were doing here in Australia and overseas, highlighting what were global best practices.”

“We wanted to set the expectation for our leadership team and help them understand that the customers of today expect that same experience whether that’s on Netflix or whether it’s their internet banking. Everybody wants this seamless, frictionless experience. That’s what we wanted to deliver at PEXA as well.”

Lisa received enthusiastic support from the CEO to make the necessary investments and commence the journey.

Member feedback

After experimenting with manual systems such as Survey Monkey, PEXA invested in a comprehensive feedback solution from Medallia. This solution was integrated into the PEXA platform. “We can trigger surveys for any transaction completed in our platform and we have an ‘always on feedback’ functionality so that our members can provide us feedback at any point in time. This means we can see how members are responding to any enhancements we make to the platform and share any feedback to make improvements quickly.”

“Every PEXA employee has the opportunity to see feedback coming back from our members in real time on an app on their mobile phone”, says Dowie. “As well as tracking Net Promoter Score (NPS) we also use Member Effort Scores (MES) to obtain feedback on how easy it is for members to complete transactions.”

Online community

A critical step to put members at the heart of everything was the establishment of an online community and forum. “It allowed our members, with their peers, to come in and share their stories, raise ideas or ask questions. It also allowed them to interact with our PEXA team.”

“One of the other things that we did which proved really successful was bringing our members into the culture that we have. PEXA is really a people first business. We have a great culture and we realised that we needed our members to experience that culture and create a deeper connection.”

“We started running open days, where we threw the doors open, normally on a Friday lunchtime, and invited our members to come in and see what happened behind the scenes. Obviously, this was prior to COVID- 19. Members would get to meet the teams they wouldn’t normally get to interact with, whether it was our technology team or our testing team or our people and culture team. They loved seeing the people they called into in our support centre.”

COVID 19 and Lockdown Restrictions

“Given that we’re a digital, agile business, and one highly committed to the experience and levels of service we provide members, we were in a pretty good shape to respond to the COVID-19 crisis and the restrictions it has imposed. In fact, our ability to adapt has meant that during the crisis we have managed to significantly improve our NPS and MES.”

During the crisis PEXA has also stayed very focused on the employee experience. The safety and wellbeing of their employees (physically and emotionally) has been a top priority. “We can’t provide a great a member experience without a great employee experience. It’s our people, whether it’s the support centre or account management teams, it’s the people in the teams that interact with our members daily that makes all the difference.”