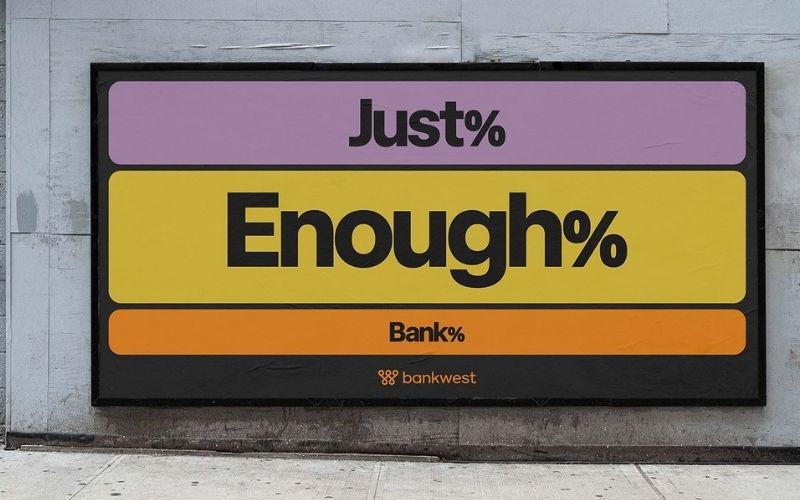

2025 saw a campaign that had some in the Australian marketing fraternity all a-flutter. Bank West is betting on a new platform in market.

“Just Enough Bank”.

In straight positioning terms, it does appear to tick a few boxes. If we assume there’s good market diagnostics informing the strategy, and we have no reason not to, then they are offering a zig to the industries usual zag.

No attempt at heart-warming images of children in the local playground, no aspirational oomph from investing in tomorrow’s track stars, and no curated corporate image of community philanthropy, or promises to stand behind local business: someone in a paisley suit shaking the hand of someone in high-viz.

No, not for Bank West.

Instead, they’re, well, banking, on the more earthy notion that everyday Aussies just need their bank to do its bloody job and get out of the way.

As one of the ads put it, “you spend only 0.02% of your time doing bank things”, before listing off other things you could be doing instead, like spending time “baking for your colleague at work. Especially Brenda”.

Ergo: people just need banking to work without fuss, and nothing more, they reckon. Apparently, it’s based on the idea of ‘proportionality’.

“Just Enough Bank’ is a big idea that will permeate through our business – and is exactly what we need at such a pivotal moment in Bankwest’s 130-year history” said Bankwest GM Customer, Marketing and Communications Jodene Murphy.

It’s a remarkably honest message, when you think about it. It essentially acknowledges that once all the account decisions are made, or after the mortgage is locked in and the credit points are rolling, banks are akin to utility providers. There’s no specific flavour to your water, power, or natural gas – no product level differentiation at all. Well, the same goes for banking. A bank account is, well, just a bank account.

I can hear the thunder of charging bankers – pun totally, totally intended – decrying my casual reduction of their products. That’s largely fair, I guess. Financial products are serious business, and all that, but as far as customer perception is concerned, I’ll counter that I’m likely closer to the money, than they are.

This is what Bank West is betting on.

This zig of theirs, enjoys some relative differentiation and the creative execution – the work of creative studio Bear Meets Eagle On Fire – certainly brings more than an oaky hint of distinctiveness. A good start then.

A closer look

Good positioning contemplates the three C’s: The Customer (or better put, the market), the Competition, and finally the Company.

Fundamentally, is it something the market wants? Again, let’s assume the data says that it is. And then, is it adequately different from the competition? Well, yeah, I think so. Don’t you? All that zigging and wot not. And lastly, is it something that the company can deliver on?

This is where Bank West’s rubber will hit the road.

If this all goes to plan, it will be entirely determined by its customer program. This isn’t trivial. While many in marketing management bemoan the statistic that only a quarter of its population is formally trained, that number plummets to nearer zero when you wander down the hallway into the various customer departments. And it usually shows.

Yet this strategy, the entire positioning – the big bet if you will – all hinges on those very departments.

Meanwhile, the bank has hit upon the universal truth that service is central to protecting brand promise. Not activations. Not personalisation of offers and campaigns. Not triggered messaging. No even the waffly notions of ‘experience’. Nope, none of it. That’s the stuff of conferences.

Aside from the product itself, which we’ve just established is as vanilla as your water, the heavy lift, and where the promise flies or dies, is in its service.

I know, I know. That’s hardly the stuff sexy rockstars chugging Verve at advertising awards, and no one at Cannes will call to congratulate them on their call deflection statistics. But in this strategy, like many, it sure is the third ‘C’ of the positioning formula. In setting their stall out, the customer program will determine, if “just enough bank” is indeed, enough.

The crux of it

Making that all just a smidge more taxing is that service delivery is much harder than it used to be. The illusion of linearity that journey maps often attempt to convey was stripped away as we entered a complex, multi-touchpoint world. Things have changed markedly since television was black and white, or even when Beverley Hills 90210 had 17-year-old boys piercing their ears.

But not everything.

Despite our digital devotions, after 5000 years’, service interactions still account for the for vast, and I mean the vaaaaaaaast, proportion of those between company and customer.

In pure marketing terms, here’s why that matters.

Most trained marketers now accept the importance of ‘physical availability’, but few grasp the reality of delivering customer channels, coherently, as an essential component of that execution. Getting that wrong can, and does, hurt many brands, but when the entire brand positioning rests on nailing precisely those fundamentals, well, Bank West need to deliver.

Coming unstuck

Compounding their challenge is that historically, banks have had all the rich data assets in the world, but not always the chops to leverage them beyond the usual calamities that lurk under the guise of ‘personalisation’ – surely a boon for the job security of privacy regulators, with little else to recommend it.

This is where many come unstuck.

In a classic case of unintended consequences, one of the enduring legacies of the digital marketing era, has seen market level concepts like segmentation and personas misappropriated at the customer level. Around the world, this and the downstream practices it leads to, has had a large role in the collapse of service.

As a central control against risks to a customer base, that’s been sub-optimal to say the very least, and the studies into loss, cost, and corporate profit erosion come flooding to mind.

An intersection in focus

Bank West have given life to a bold new strategy. Only time will tell if that translates to the folding stuff but in the meanwhile, the kooky creative will live for a decent while in our memory. Salience, baby. Mental availability. Oorah!

But dysfunction in the service layer, is dysfunction in physical availability – the other half of the availability equation. As I tend to say a lot, the hip bone is connected to the thigh bone…

While the creatives will rave about the storytelling, and marketing academics will ponder the ingredients of the underlying brand strategy, what Bank West has really done, is shine a light on the critical intersection of brand and customer program execution.

An article in WARC recently claimed that as many as 60% of CMOs already have responsibility for the customer base. This intersection should have your attention.

Pulling off ‘Just Enough Bank’ promises to be harder than it looks. They seem to have satisfied a couple of the three Cs, but the last one, the company’s ability to deliver on it, will decide its real fate. I wish them well.